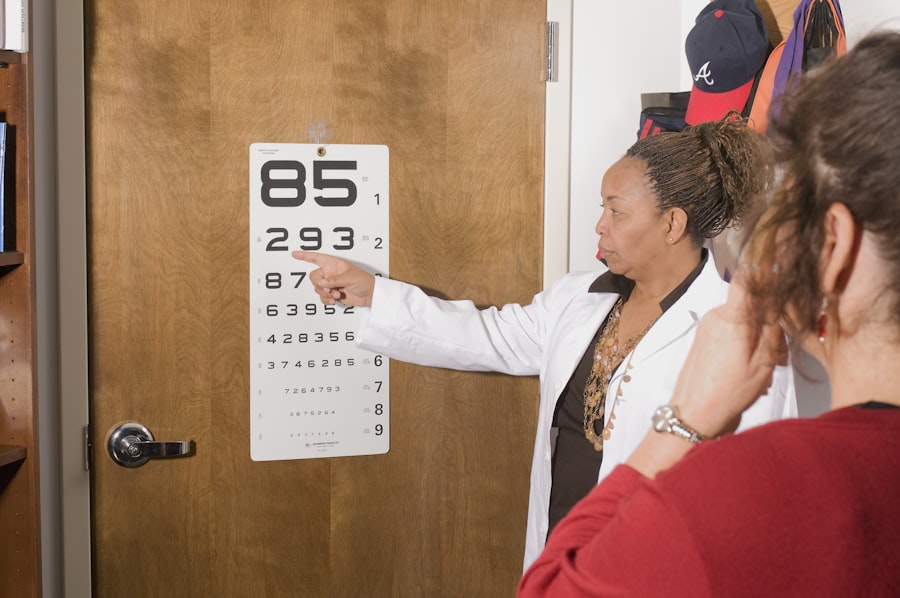

Vision insurance is an essential component of overall health and wellness. Many people overlook the importance of regular eye exams and vision care, but maintaining good vision is crucial for daily activities and overall quality of life. Vision insurance helps individuals and families afford the cost of routine eye exams, prescription eyewear, and contact lenses, as well as providing coverage for more serious eye conditions and diseases. Without vision insurance, the cost of these services can add up quickly, making it difficult for individuals to prioritize their eye health. By having vision insurance, individuals can ensure that they have access to the care they need to maintain healthy vision and catch any potential issues early on. This can ultimately lead to better overall health and well-being.

Vision insurance also plays a crucial role in preventative care. Regular eye exams can detect early signs of serious health conditions such as diabetes, high blood pressure, and even certain types of cancer. By catching these issues early, individuals can seek treatment sooner and potentially prevent more serious health complications down the line. Additionally, vision insurance can help individuals afford the cost of corrective lenses, which are essential for many people to perform their jobs and daily activities. Overall, vision insurance is an important investment in one’s health and well-being, providing access to essential eye care services and contributing to overall quality of life.

Key Takeaways

- Vision insurance is important for maintaining healthy eyes and preventing vision problems.

- Guardian Vision Insurance offers coverage for eye exams, glasses, and contact lenses, making it easier to access vision care.

- The benefits of Guardian Vision Insurance include cost savings on eye care and access to a wide network of vision providers.

- Using Guardian Vision Insurance is simple, requiring only a membership card and a visit to a participating provider.

- Finding a provider with Guardian Vision Insurance is easy with the online provider directory and customer service assistance.

Understanding Guardian Vision Insurance Coverage

Guardian Vision Insurance offers comprehensive coverage for individuals and families, providing access to a wide range of vision care services. With Guardian Vision Insurance, members can receive coverage for routine eye exams, prescription eyewear, contact lenses, and even discounts on laser vision correction surgery. The insurance also provides coverage for more serious eye conditions and diseases, ensuring that members have access to the care they need to maintain healthy vision.

One of the key benefits of Guardian Vision Insurance is its extensive network of providers, making it easy for members to find a qualified eye care professional in their area. The insurance also offers flexibility in choosing eyewear, allowing members to select from a wide range of frames and lenses to suit their individual style and needs. Additionally, Guardian Vision Insurance provides affordable coverage options, making it accessible for individuals and families of all budgets. Overall, Guardian Vision Insurance offers comprehensive coverage and a range of benefits to help members maintain healthy vision.

Benefits of Guardian Vision Insurance

Guardian Vision Insurance offers a wide range of benefits to its members, making it an essential investment in one’s overall health and well-being. One of the key benefits of Guardian Vision Insurance is its coverage for routine eye exams. Regular eye exams are essential for maintaining healthy vision and detecting any potential issues early on. With Guardian Vision Insurance, members can receive coverage for these exams, ensuring that they have access to the care they need to keep their eyes healthy.

In addition to routine eye exams, Guardian Vision Insurance also provides coverage for prescription eyewear and contact lenses. This can help individuals afford the cost of essential corrective lenses, ensuring that they can perform their daily activities with clear vision. The insurance also offers discounts on laser vision correction surgery, providing members with an affordable option for permanent vision correction. Overall, Guardian Vision Insurance offers a range of benefits to help members maintain healthy vision and access the care they need to keep their eyes in optimal condition.

How to Use Guardian Vision Insurance

| Benefits | Details |

|---|---|

| Eye Exams | One eye exam per year |

| Frames | One pair of frames every two years |

| Lenses | One pair of lenses every year |

| Contact Lenses | One pair of contact lenses every year |

| Discounts | Discounts on additional eyewear purchases |

Using Guardian Vision Insurance is a straightforward process that begins with finding a qualified eye care professional within the insurance network. Once a provider is selected, members can schedule a routine eye exam or any necessary vision care services. During the visit, members can present their Guardian Vision Insurance information to the provider’s office staff, who will then verify coverage and benefits. Depending on the specific plan, members may have a copay or deductible to meet for certain services.

After the visit, members can choose from a wide range of frames and lenses if they require prescription eyewear. The provider’s office staff can assist in selecting the appropriate eyewear based on the member’s prescription and style preferences. If contact lenses are needed, members can also use their Guardian Vision Insurance benefits to cover the cost of these lenses. Overall, using Guardian Vision Insurance is a simple process that allows members to access the care they need to maintain healthy vision.

Finding a Provider with Guardian Vision Insurance

Finding a provider within the Guardian Vision Insurance network is easy and convenient. Members can visit the Guardian website or contact customer service to locate a qualified eye care professional in their area. The insurance network includes a wide range of providers, including optometrists and ophthalmologists who offer comprehensive vision care services. Members can search for providers based on location, specialty, and even patient reviews to find a provider that meets their individual needs.

Once a provider is selected, members can schedule an appointment for a routine eye exam or any necessary vision care services. The provider’s office staff can assist in verifying coverage and benefits under the member’s Guardian Vision Insurance plan. This streamlined process makes it easy for members to find a qualified provider and access the care they need to maintain healthy vision.

Tips for Maintaining Healthy Vision

In addition to having vision insurance and accessing regular eye care services, there are several tips individuals can follow to maintain healthy vision. First and foremost, it’s important to eat a balanced diet rich in fruits and vegetables, as certain nutrients such as vitamin C and E, zinc, and omega-3 fatty acids are essential for maintaining good eye health. Additionally, wearing sunglasses that block out UV rays can help protect the eyes from sun damage and reduce the risk of cataracts.

Another important tip for maintaining healthy vision is to take regular breaks when using digital devices such as computers and smartphones. Staring at screens for extended periods can cause digital eye strain and fatigue, so it’s important to follow the 20-20-20 rule: every 20 minutes, take a 20-second break and look at something 20 feet away. Lastly, it’s crucial to avoid smoking, as it has been linked to an increased risk of age-related macular degeneration, cataracts, and optic nerve damage.

Making the Most of Your Guardian Vision Insurance

To make the most of Guardian Vision Insurance, it’s important for members to take advantage of all the benefits offered by their plan. This includes scheduling regular eye exams to ensure that any potential issues are caught early on and receiving coverage for prescription eyewear or contact lenses as needed. Members should also explore any additional benefits offered by their plan, such as discounts on laser vision correction surgery or other vision care services.

It’s also important for members to stay informed about their coverage and benefits under their Guardian Vision Insurance plan. This includes understanding any copays or deductibles that may apply to certain services and being aware of any limitations or exclusions within the plan. By staying informed about their coverage, members can make informed decisions about their vision care and maximize the benefits offered by their insurance plan.

In conclusion, vision insurance is an essential component of overall health and wellness, providing access to essential eye care services and contributing to overall quality of life. Guardian Vision Insurance offers comprehensive coverage for individuals and families, with benefits including coverage for routine eye exams, prescription eyewear, contact lenses, and discounts on laser vision correction surgery. By understanding how to use Guardian Vision Insurance and finding a qualified provider within the insurance network, members can access the care they need to maintain healthy vision. Additionally, following tips for maintaining healthy vision and making the most of their insurance benefits can help individuals make their eye health a priority and ensure that they have access to essential vision care services.

Looking for comprehensive vision insurance coverage? Guardian Vision Insurance offers a range of plans to suit your needs. Whether you’re looking for basic coverage or more extensive benefits, Guardian has you covered. And if you’re interested in exploring other healthcare products, check out MedShopsOnline for a wide selection of medical supplies and equipment. With their convenient online platform, you can easily find the products you need and have them delivered right to your door. MedShopsOnline offers a convenient and reliable way to access the healthcare products you require.

FAQs

What is Guardian Vision Insurance?

Guardian Vision Insurance is a type of insurance plan that provides coverage for vision-related expenses such as eye exams, prescription eyewear, and contact lenses.

What does Guardian Vision Insurance cover?

Guardian Vision Insurance typically covers the cost of annual eye exams, prescription eyeglasses, contact lenses, and frames. Some plans may also offer discounts on LASIK surgery and other vision correction procedures.

How does Guardian Vision Insurance work?

With Guardian Vision Insurance, policyholders pay a monthly premium in exchange for coverage of vision-related expenses. When they need to use their benefits, they can visit a network provider and receive discounted services or submit a claim for reimbursement.

Is Guardian Vision Insurance part of a larger insurance plan?

Guardian Vision Insurance is often offered as a standalone plan, but it can also be included as part of a larger dental or health insurance package.

Where can I use Guardian Vision Insurance?

Policyholders can use their Guardian Vision Insurance benefits at a network of eye care providers, including optometrists, ophthalmologists, and optical retailers.

How do I enroll in Guardian Vision Insurance?

Enrollment in Guardian Vision Insurance typically occurs during open enrollment periods or when individuals experience qualifying life events. Employers may also offer it as part of their benefits package.